One popular choice is a solar loan. These loans let you take out money to cover the full cost of the system, and you’ll pay it back over time. The best part? You can often start enjoying the benefits of solar energy while you’re still paying off your loan!

Another great option is leasing. With a lease, you can install solar panels without the hefty price tag. You pay a monthly fee to use the panels, and the leasing company usually takes care of the maintenance. It’s a stress-free way to dive into solar without feeling like you’re drowning in costs.

Don’t forget about available incentives, like tax credits and rebates! These can reduce the overall cost of installation, making solar panel financing even easier. You might find that the savings on your energy bill help cover your payments, which feels like a win-win!

If you’re ready to dive into the solar world, consider these smart financing options for solar panels. With a little planning, you can start saving money and the environment without breaking the bank!

Understanding Your Solar Loan Choices

When you’re diving into solar panel financing, it’s super important to know your options. There are a few main paths you can take, and each has its perks. Understanding these different types of loans can help you pick what suits your budget and energy goals best.

First up are solar loans. These tend to be straightforward. You borrow money to cover the cost of your solar panels and pay it back over time. Depending on your credit score and other factors, you could find loans with low-interest rates. This option is great if you want to own your system outright and enjoy long-term savings on your energy bills.

Leases are another choice. With a solar lease, you essentially rent your solar system from a provider. You pay a fixed monthly fee for using the panels but don’t own them. This can be appealing if you want to avoid the upfront costs of buying, but keep in mind that you won’t receive all the benefits of ownership, like tax credits and rebates.

Power Purchase Agreements (PPAs) work similarly to leases but focus on the energy produced. You pay for the electricity generated by the solar panels at a set rate. If you want a way to save on your energy bill without a large investment up front, this could be your thing. Just remember you’re not technically owning the panels, which could affect your long-term savings.

Whichever route you choose, doing your homework is key. Compare interest rates, read the fine print, and ask questions! Solar panel financing doesn’t have to be overwhelming. With a little research, you can find the best option that fits your needs.

Spartan Power Black Solar Panel Mount Brackets - Set of 4

Easily secure your solar panels with these durable and reliable brackets

Product information

€12.68

Product Review Score

4.5 out of 5 stars

197 reviewsProduct links

How to Save with Solar Financing

Thinking about going solar but worried about the upfront costs? You're not alone. Many people feel the same way, which is where Solar Panel Financing comes in. This option makes solar more accessible by breaking down the costs into manageable payments. That way, you can start saving on your energy bills right away while paying over time.

There are several financing options available. For example, solar loans let you pay for your system over a set period while enjoying the benefits of solar energy immediately. You can also look into solar leases, where a third party owns the system, and you simply pay a monthly fee. This means you don’t have to worry about installation or maintenance; it's all taken care of for you.

Another cool option isPower Purchase Agreements (PPAs). With a PPA, you pay for the electricity the system generates rather than the system itself. This way, there's no hefty upfront cost, and your payments can be lower than your current electricity bill. Plus, many states offer incentives and rebates that can further reduce your costs.

When considering Solar Panel Financing, don’t forget to shop around. Different lenders offer different rates and terms, so it's smart to compare your options. Look for low-interest rates and flexible payment plans that fit your budget. And remember, investing in solar is not just about saving money; it's about investing in a sustainable future.

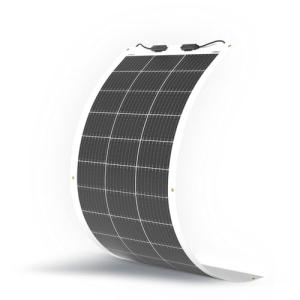

100W Monocrystalline Solar Panel for Off-Grid Use

Harness the power of the sun for efficient energy solutions in remote locations

Product information

€97.29 €57.52

Product Review Score

4.38 out of 5 stars

156 reviewsProduct links

Steps to Get Started with Solar Financing

Getting started with solar panel financing doesn’t have to be a hassle. You can take a few simple steps to make the process smooth and straightforward. Let’s break it down!

First off, figure out your budget. Knowing how much you can spend on solar panel financing will help you choose the right plan. Think about your monthly bills, how much you want to save, and if you’re ready to invest a little upfront. It can be helpful to jot down your financial goals so you have a clear picture.

Next, do your homework on different financing options. You’ve got choices like solar loans, leases, and power purchase agreements (PPAs). Each option has its perks and downsides, so dig in and see what fits your situation best. A good tip is to compare rates and terms from different lenders. This can save you a ton of cash in the long run.

After that, reach out to local solar providers. They can help you navigate the available financing options while offering their expertise on installation. Ask about any incentives that may be available in your area – tax credits or rebates can really boost your savings when it comes to solar panel financing.

Finally, take your time reviewing the contract before you sign anything. You want to fully understand the terms and ensure they align with your financial goals. Don’t hesitate to ask questions! A good provider will be happy to explain everything to you, so you can feel confident about your investment in solar energy.