Want to make the most of your solar investment? Understanding and maximizing your solar savings through Solar Panel Incentives can really make a difference. These incentives can range from federal tax credits to state rebates, making solar more affordable for everyone.

First off, check out the federal solar tax credit. You can get a significant percentage back on your federal taxes just for installing solar panels. This credit has been a game changer for many homeowners, helping to reduce the overall cost of going solar. Make sure you understand the timeline to claim it – you don’t want to miss out!

Next up are state and local incentives. Many states offer additional tax credits or grants. Some even have special programs that let you sell back excess energy. These incentives can really pile up and make your solar installation even more cost-effective.

Look into financing options too. Many banks and solar companies offer loans specifically for solar installations, often with lower interest rates. This way, you can spread out the costs while still benefiting from those Solar Panel Incentives. Plus, check if your state has any zero-interest loan programs. You could save a ton while going green!

Finally, don’t forget to educate yourself about net metering. This lets you earn credits for the excess power your solar panels generate. When you use less energy than you produce, those credits can help lower your electricity bills. Understanding these details is key to maximizing your savings and enjoying your solar journey. Dive into those Solar Panel Incentives and see how much you can save!

Understand Available Tax Credits

When it comes to solar panel incentives, understanding the tax credits available can make a huge difference in your wallet. The federal solar tax credit, also known as the Investment Tax Credit (ITC), allows you to deduct a significant percentage of your solar installation costs from your federal taxes. Right now, that’s a solid 30%! This means if you spend $20,000 on your solar panels, you could potentially save $6,000 on your taxes.

But don't just stop at the federal level. Many states offer their own solar panel incentives. These can include additional tax credits, rebates, or even performance-based incentives that pay you for the energy your system generates. Each state has different programs, so it’s worth checking what’s available in your area. Some utility companies also have cash incentives for going solar, which can really sweeten the deal.

Make sure you’re aware of any deadlines or changes in tax laws. The federal tax credit is set to decrease after 2023, so if you’re thinking about going solar, now’s the time to act. Diving into the details of these solar panel incentives can feel overwhelming, but grabbing these savings is totally worth it. Don’t hesitate to reach out to your tax advisor or a solar professional who can help you navigate the ins and outs of these incentives.

Remember, every dollar counts when it comes to investing in solar energy. By taking full advantage of the available tax credits and other programs, you can significantly lower the overall cost of your solar system. That means not only a smaller upfront payment but also a faster return on your investment. So, roll up your sleeves and start digging into those solar panel incentives. Your future self will thank you!

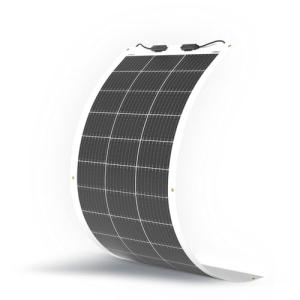

BougeRV Yuma 100W Flexible Solar Panel System

Experience unmatched versatility and power efficiency for your off-grid adventures with the BougeRV Yuma 100W Flexible Solar Panel System

Product information

€228.43 €186.12

Product Review Score

4.48 out of 5 stars

144 reviewsProduct links

Explore Local Incentive Programs

When it comes to Solar Panel Incentives, one of the best places to start is with local programs. These incentives can vary a lot from one place to another, so it pays to do a little homework on what's available in your area.

Many states and municipalities offer rebates or tax credits to encourage folks to go solar. For instance, some areas might offer cash back on your initial installation costs, making your solar investment more affordable right from the get-go. Check out your local government’s website or give them a call to see what’s out there.

Don’t forget about utility companies! Some of them have programs designed to help you save more money. They might have special rates or incentives for customers who use solar energy. It’s definitely worth your time to reach out and ask about any programs they offer.

Finally, get connected with local solar provider groups. They often have the inside scoop on the latest incentives and can guide you through the process. They can help you navigate the paperwork and ensure you don’t miss out on any savings.

30A Solar Charge Controller with Dual USB Ports

Power up your devices efficiently while keeping your batteries charged and ready to go

Product information

€12.98

Product Review Score

4.97 out of 5 stars

161 reviewsProduct links

Read the Fine Print Carefully

When diving into Solar Panel Incentives, it’s super important to read the fine print. You don’t want any surprises later, right? Many incentives can come with specific requirements or conditions that you need to meet to actually benefit. That means checking the eligibility criteria, application deadlines, and any documentation you'll need to provide.

Some solar incentives may have caps on how much you can claim, or they might only apply to certain types of solar installations. Keep an eye out for these details because they can significantly impact the total savings you expect. It’s like finding out there’s a limit on a coupon you thought was unlimited. No one wants that.

Also, be aware of how long these incentives last. Some might change from year to year, or even seasonally. You might find that the rebate you were counting on isn’t available when you finally decide to go solar. Staying updated and understanding the timeline of Solar Panel Incentives can save you a ton of headache down the line.

And let’s not forget about local versus federal incentives. They can change things up in unexpected ways. Sometimes, state programs are way better than the federal ones, or vice versa. Knowing the difference can help you maximize your savings by stacking incentives. Take the time to dig into these details; it’s worth it to get the best bang for your buck!