Thinking about going solar? One of the best parts about investing in solar panels is the potential tax credits you can snag. These Solar Panel Incentives can really help you save some cash while making the switch to renewable energy. Every little bit helps, right?

The federal solar tax credit, also known as the Investment Tax Credit (ITC), is a big deal. You can deduct a significant percentage of your solar panel installation costs from your federal taxes. For example, if you spend $20,000 on a solar system and the ITC is at 26%, you could save around $5,200 on your tax return. It's like getting a nice chunk of your money back!

But wait, there’s more! Many states offer their own Solar Panel Incentives, too. This could mean additional tax credits, rebates, or even performance-based incentives. Depending on where you live, these can add up quickly, making solar more affordable than you might think. Check with your local government or utility company to see what’s available in your area.

Plus, some places even allow for property tax exemptions on solar installations. That means when you add solar panels to your home, it doesn’t increase your property taxes! All these incentives make it easier to switch to solar and enjoy the benefits without breaking the bank.

State Programs for Solar Savings

When it comes to saving money on solar installation, state programs can be a game changer. Many states offer solar panel incentives that help cover the costs and make going green way more accessible. These programs vary, so it’s worth researching what your state has in store.

One common type of incentive is the rebate program. States often provide cash rebates that reduce the upfront cost of solar panels. Some areas even have incentives that let you recoup a chunk of your investment after your solar system is installed. Imagine getting a nice paycheck after making the switch; that’s the power of state programs!

Tax credits are another popular option. With federal tax credits available, many states offer additional credits to sweeten the deal. These can seriously cut down your tax bill and make going solar even more financially attractive. Be sure to ask a tax professional how these solar panel incentives could work for you!

Don't forget about financing programs either. Some states provide low-interest loans for solar installations, allowing you to pay for your system over time. This means you can start enjoying those energy savings immediately without breaking the bank. Look for these options – they can help you go solar without a hefty upfront payment!

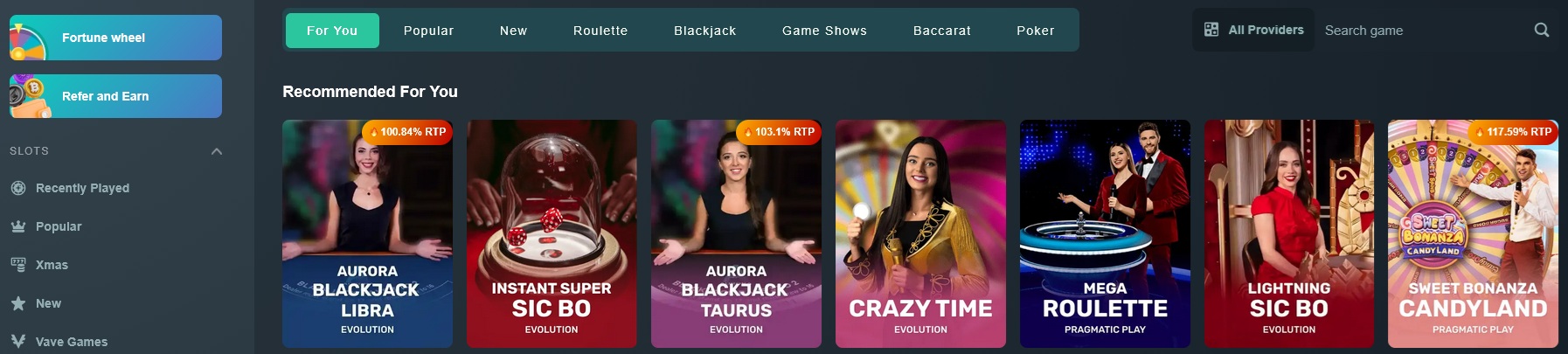

BougeRV 200W Bifacial Solar Panel for RVs and Homes

Get reliable power for your RV adventures or home energy needs with this versatile bifacial solar panel

Product information

€211.51 €143.82

Product Review Score

4.84 out of 5 stars

139 reviewsProduct links

Federal Rebates You Should Know About

When you think about going solar, the costs can feel overwhelming at first. But here’s the thing: there are some amazing federal rebates out there that can ease the financial burden. These Solar Panel Incentives can help you save big on your investment in renewable energy. Let’s break down what you need to know.

The most popular incentive is the Federal Investment Tax Credit (ITC). This allows you to deduct a chunk of your solar installation costs from your federal taxes. As of now, you can claim a whopping 30% of the total system cost! That’s a huge boost to your savings, especially when the average solar system runs in the tens of thousands of dollars.

Another perk is the ability to sell excess energy back to the grid. If your solar panels generate more electricity than you use, you might get credits on your electricity bill through net metering. That means your solar panels not only cut your bills, but they can also make you some money!

Finally, some states stack their own rebates and incentives on top of the federal options. This varies by state, so it’s worth checking what your local government offers. Look for grants, rebates, or even property tax exemptions that can add even more savings to your solar journey. With all these Solar Panel Incentives, going green is looking much better, right?

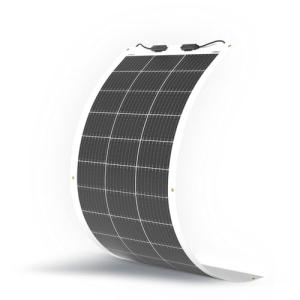

200W 12V/24V Monocrystalline Solar Panel Kit

Harness the sun's energy for sustainable power solutions with our efficient 200W Monocrystalline Solar Panel Kit

Product information

€160.74 €126.90

Product Review Score

4.98 out of 5 stars

118 reviewsProduct links

Financing Options for Solar Panels

Thinking about solar panels but worried about the cost? You’re not alone! Many people ask about financing options when exploring solar panel incentives. Luckily, there are several pathways that can make solar more affordable.

First off, a lot of states offer solar loans specifically designed for homeowners. These loans come with low-interest rates, making it easier for you to pay off the installation costs over time. Some programs even allow for flexible repayment plans that can fit right into your budget.

Another option to consider is leasing. With a solar lease, you can install panels on your property without any hefty upfront payments. Instead, you pay a monthly fee to use the system. This can be a great way to enjoy the benefits of solar energy while keeping your cash flow in check. Plus, you still might qualify for some solar panel incentives!

Then, there are Power Purchase Agreements (PPAs). Similar to leasing, a PPA lets you pay for the power generated by the solar panels instead of outright purchasing them. This means a lower initial cost, and you can typically lock in a lower rate than what you’d pay your utility company.

Take a moment to explore these financing options when looking into solar panel incentives. They can unlock savings and help turn your solar dreams into reality!