When you're considering installing solar panels, figuring out how to pay for them can feel overwhelming. But don’t worry—solar panel financing options are here to help you make the switch without breaking the bank. You can take your time and choose a method that fits your budget and lifestyle.

One popular option is a solar loan. This is like any other loan; you borrow the money to pay for your solar panels and then repay it over time, usually with interest. The great part? Many loans are secured by the solar system itself, which can lead to better interest rates. Plus, you can start saving money on your electric bills right away while paying off the loan.

If you prefer not to worry about monthly payments, leasing is another route. With a solar lease, you pay a fixed monthly fee to use the solar system installed on your property. You don’t own the panels, but you're still able to benefit from clean energy and lower electric bills! This option is fantastic for people who want immediate savings without the upfront costs.

Another way to finance solar is through power purchase agreements (PPAs). With a PPA, a third party installs solar panels on your property, and you pay them for the energy produced. It’s like leasing but with even more flexibility. You usually pay a rate that’s lower than your local utility, so you can still enjoy those savings while someone else takes care of the maintenance.

Whichever financing option you pick, it’s essential to do your homework. Look at the terms, interest rates, and any potential savings you can get. Understanding solar panel financing isn't just about making a purchase; it’s about investing in a cleaner future while keeping your finances in check!

Tips for Budgeting Your Solar Investment

Budgeting for solar panel financing can feel overwhelming, but it doesn’t have to be. Start by figuring out how much you want to spend and what kind of system you need. Take some time to research the types of solar panels available and their costs. You’ll see there's a range of options, and that means you can find something that fits your budget.

Next, look into financing options. Many solar providers offer payment plans, or you might find a bank that offers loans specifically for solar investments. Consider tax credits or incentives from your local government. They can really help reduce upfront costs, making solar panel financing much more manageable.

Don't forget to factor in your home’s energy needs. Analyze your electricity bills to see how much energy you typically use. This will help you choose a system that matches your consumption. If you pick a system that’s too big, you could end up spending more than necessary. A tailored solution saves you money in the long run.

Finally, think about maintenance costs. Some solar panels need regular upkeep, while others are almost zero-maintenance. Be sure to include these potential costs in your budget. This way, you’ll have a clearer picture of your solar panel financing journey and won’t get hit by unexpected expenses down the road.

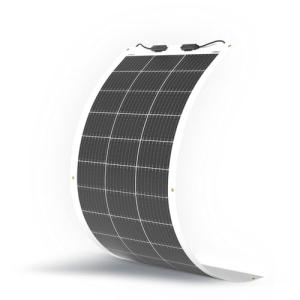

Renogy 100W Flexible Monocrystalline Solar Panel

Experience efficient energy generation with the lightweight and versatile design of the Renogy 100W Flexible Monocrystalline Solar Panel

Product information

€149.99

Product Review Score

4.75 out of 5 stars

101 reviewsProduct links

Maximizing Savings with Solar Incentives

Solar panel financing can feel overwhelming at first, but there are plenty of incentives that can help you save big on your investment. States and even the federal government offer various programs to make going solar more affordable. Let’s break down some of the best ways to maximize your savings.

One of the biggest incentives you can tap into is the federal solar tax credit, also known as the Investment Tax Credit (ITC). Currently, you can deduct a percentage of your solar system’s cost from your federal taxes. This credit can mean thousands back in your pocket, making solar panel financing much easier to handle. Just make sure to check the details so you don’t miss out!

Many states also have their own programs. Some offer rebates for installing solar panels, while others provide performance-based incentives. This means you'll get paid based on how much energy your solar system produces. Don’t forget about local utility companies! They might have special offers or incentives that can kick your savings up a notch.

If you’re feeling adventurous, consider solar renewable energy certificates (SRECs). These can be sold when you generate solar energy, allowing you to earn income on top of your energy savings. It’s like getting paid to go green! Just check if your state has SREC programs and how to enroll.

Finally, don't overlook financing options that cater to those looking to make the switch. Some banks and solar companies provide specific loans or leases that come with lower interest rates when you opt for renewable energy. This moves solar panel financing from being a burden to a smart investment.

SUNMAK 16 Solar Panel Mounting Brackets Set

Easily install your solar panels with these durable and adjustable mounting brackets for secure support

Product information

€32.23

Product Review Score

4.42 out of 5 stars

55 reviewsProduct links

Choosing the Right Loan for Solar Panels

When it comes to solar panel financing, picking the right loan can feel a bit overwhelming. You’ve got options, and knowing what works best for your situation will make a big difference down the road. Let’s break it down into bite-sized pieces so you can feel confident in your choice.

First off, think about what you can afford. Different loans come with different terms and interest rates. Some might have lower monthly payments but stretch out over a longer period—meaning you could end up paying more in the long run. Others might have higher payments but get paid off quicker. Make sure to check your budget and what fits in comfortably each month.

Also, look for loans that cater specifically to solar projects. These can offer better rates and terms compared to regular loans because lenders see solar panels as a solid investment. Ask about any incentives or rebates available in your area that might help lower your overall costs. Every bit helps, right?

Don't forget to consider the overall reputation of the lender. Read reviews and see what other customers say about their experiences. A lender that’s responsive and helpful can make the financing process much smoother. After all, you want your solar panel financing experience to be as stress-free as possible!

Lastly, compare offers from multiple lenders. Just like shopping around for the best solar panels, you should explore different financing options to snag the best deal. Take your time, review the terms, and choose a loan that fits your financial goals and long-term plans for your solar setup.